🛡️ The Trust Protector: Your Trust's Long-Term Safeguard

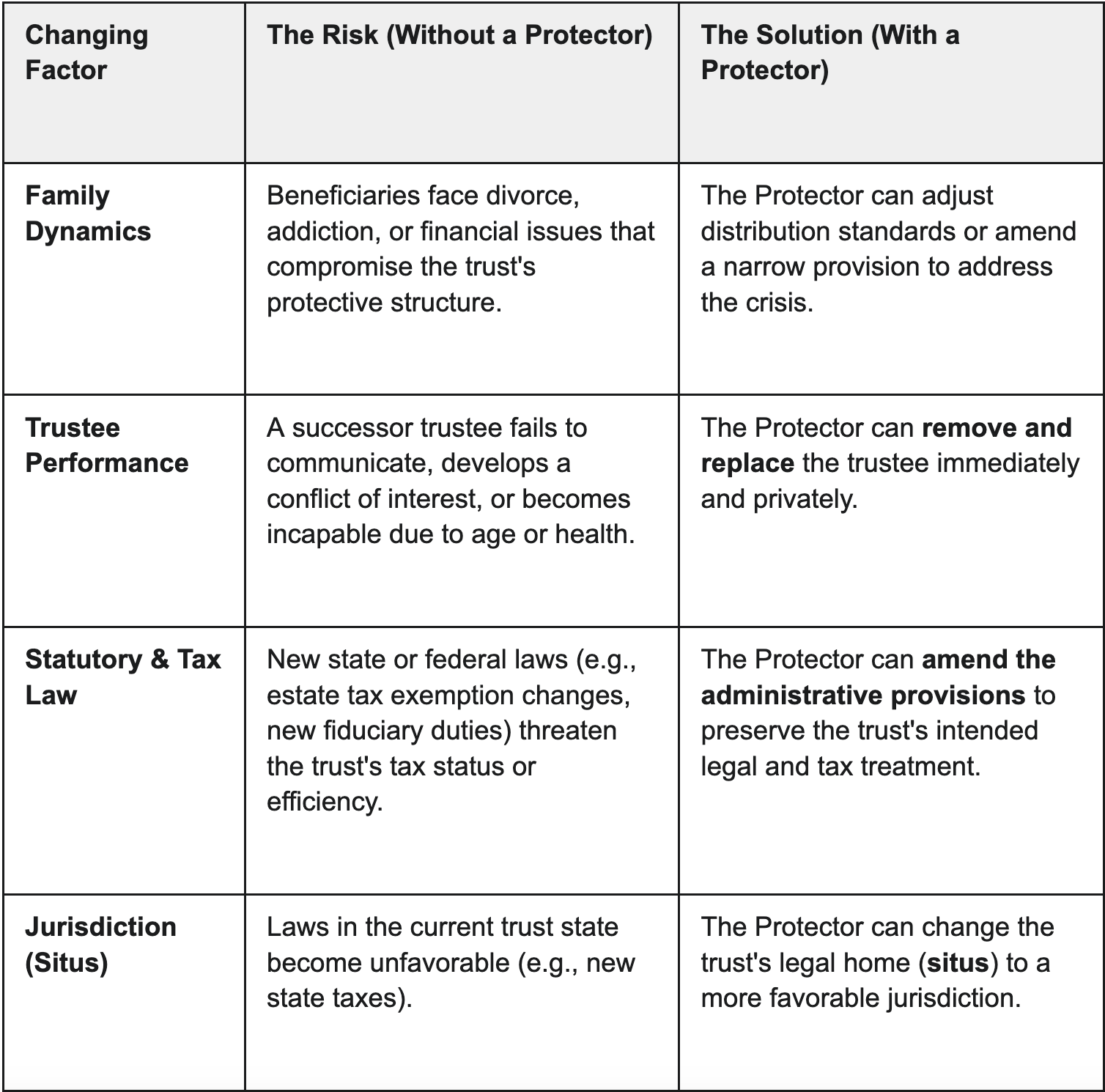

Estate planning documents are designed to endure across generations. However, laws change, family dynamics shift, and trustees may become unfit or uncooperative. The Trust Protector is the critical provision that allows your trust to adapt without requiring expensive court intervention.

Trust Protector

A Trust Protector is the quiet safeguard that keeps your legacy on course.

What Is a Trust Protector? (The Core Function)

A Trust Protector is an individual or professional entity granted specific, limited powers by the Grantor (the person who created the trust).

They are not a Trustee and do not manage, invest, or distribute trust assets. They act as a fiduciary check-and-balance—a neutral third party or "safety valve"—whose sole purpose is to ensure the trust continues to operate according to the Grantor's original intent, even as circumstances evolve.

Think of a Trust Protector as:

A non-judicial referee who can resolve internal disputes privately.

A designated agent of change who can modernize the trust when laws change.

The person who prevents your family from needing costly, public court modification (cy pres).

Why Trust Protectors Are Essential Today

Trust Protectors, once reserved for complex, dynasty, or offshore trusts, are now considered a best practice for most trusts due to increasing legal and social complexities:

🔨 Common & Precise Powers Granted

The powers granted must be explicitly defined in the trust document. They are generally non-routine and triggered only by specific events:

Trustee Removal and Appointment: The most common power, allowing the Protector to fire an unfit or uncooperative trustee and name a successor.

Trust Modification/Amendment: The power to make narrow, administrative changes to the trust document to adapt to new tax or state laws (often called a Decanting Power in some states, which the Protector may approve or veto).

Veto Power: The ability to approve or reject certain non-routine actions proposed by the Trustee (e.g., selling a large asset).

Resolution of Disputes: Authority to mediate or privately decide conflicts between co-trustees or between a trustee and a beneficiary.

Change of Trust Situs (Governing Law): The authority to move the trust's legal jurisdiction to ensure better asset protection or tax efficiency.

Who Might Not Need One?

While most trusts benefit, a Protector might be considered optional for:

Simple, Testamentary Trusts: Trusts that distribute assets outright immediately after the Grantor's death, involving little to no long-term administration.

Short-Duration Trusts: Trusts that are set to terminate within a very short timeframe (e.g., 5 years) and have no significant contingent beneficiaries.

Conclusion: For any trust intended to last for decades (e.g., trusts for minors, special-needs planning, staggered distributions, or tax planning), the Trust Protector is the most effective tool to build necessary flexibility and non-judicial dispute resolution into your legacy plan.