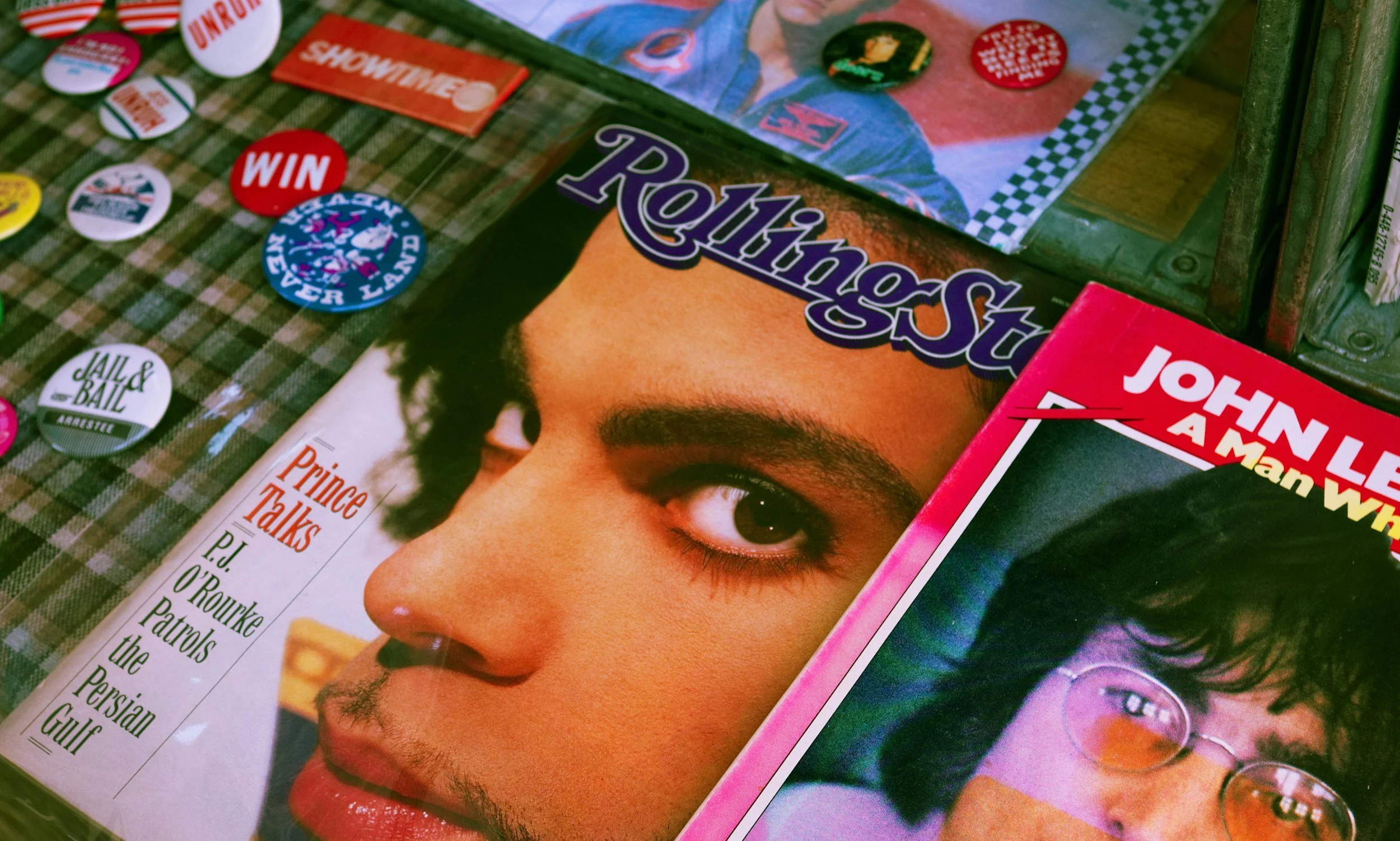

What Went Wrong With Prince’s Estate — and How It Could Have Been Avoided

Prince was worth hundreds of millions of dollars, controlled his art with precision, and guarded his privacy fiercely.

Yet when he died, he left behind no will, no trust, and no written instructions—forcing the courts to take over his legacy.

What followed was years of litigation, massive tax exposure, and decisions he no longer had any say in.

This is what went wrong—and how it could have been avoided.

Frozen Accounts, Court Delays, and Grief: What Happens in the Probate Process

Your mom told you not to worry; she had everything handled. You were her power of attorney, helping her pay bills and manage her accounts. When she passed away, you assumed you'd simply continue handling things the same way you had been.

Then you tried to deposit the insurance check. The bank clerk looked at the check, looked at your power of attorney paperwork, and shook her head. "I'm sorry, but we can't accept this. You'll need to go through the probate court first."

Suddenly, you're facing a legal process you know nothing about, at a time when you can barely function through your grief. The mortgage payment is due. Bills are piling up. And everything you thought was handled has turned into a complicated mess.

How to Assign Your California LLC to Your Living Trust (Step-by-Step)

Assigning your LLC to your living trust in California isn’t complicated—but it is precise. Many people assume they need to “move” the LLC itself into the trust, when in reality the legal process is about assigning ownership interests, not assets. In this step-by-step guide, we walk through the legally correct way to assign your California LLC to your living trust, explain common mistakes that cause problems later, and share practical insights most people only learn after a costly cleanup. If you own an LLC and have (or are creating) a living trust, this is required reading.

Why Meal Planning and Estate Planning Are Surprisingly Similar

Meal planning and estate planning have more in common than you think. Both reveal how you value time, money, and family—and both can either reduce stress or create chaos. Learn why intentional planning is one of the greatest gifts you can leave your loved ones.

What Should Be Done After Someone Passes Away in California (If They Had a Living Trust)

Most people don’t realize what being named as a trustee in California actually means — until they’re grieving and suddenly responsible for legal notices, property, taxes, and family expectations. This guide walks you through what must and what should be done after someone passes away with a living trust, helping you avoid costly mistakes and move forward with clarity and confidence.

What Is an AB Trust — And Why Many Californians Should Update Theirs Today

Learn what an AB Trust is, why it was once popular, and why California families with older AB Trusts should consider a modern restatement to avoid taxes and complications.

⚖️ Understanding the Roles of Your Health Care Agent and the Long-Term Care Ombudsman in California Estate Planning

🌿 Who really protects you when you can’t speak for yourself?

In California, two very different roles look out for your well-being: your Health Care Agent (named in your estate plan) and the Long-Term Care Ombudsman (a state-backed advocate for anyone in assisted living or nursing homes).

Most families don’t realize these roles work together to protect your medical wishes, dignity, and rights — but only one of them must be chosen before something happens.

Who Will Really Get Your Pet? The Hidden Costs and Questions Most People Never Plan For

The Overlooked Part of Estate Planning**

Most families assume someone will step in if something happens to them — but caregiving is emotional, expensive, and not always realistic. Pets often end up in shelters or with overwhelmed relatives.

California Pet Trusts let you:

Choose a primary & backup caregiver

Leave funds for food, vet care, meds & emergencies

Provide instructions for routine, diet & medical needs

Ensure the pet is protected for life

Avoid family disputes or court placements

Understanding Legal Capacity: Why Wills, Powers of Attorney, and Trusts Require Different Levels of Capacity

Capacity is one of the most important — and overlooked — parts of estate planning. Before creating a Will, Power of Attorney, or Trust, an attorney must confirm the client understands what they’re signing.

Here’s the quick breakdown:

Will: Lowest level of capacity. Client must know their property, their heirs, and the effect of a Will.

Power of Attorney: Higher capacity. They must understand the powers they’re giving someone else.

Trust: Typically the highest capacity. Requires the ability to understand rights, risks, and long-term management.

Attorneys evaluate clarity, memory, ability to explain decisions, and whether there is undue influence. A few minutes of assessment protects the client — and prevents family disputes later.

If you’re helping a parent or spouse and aren’t sure if they have the capacity to sign, we’re always here to guide you.

🛡️ The Trust Protector: Your Trust's Long-Term Safeguard

A Trust Protector is the modern “safety valve” built into today’s family trusts — someone who steps in only when needed to keep your wishes protected as life and laws change. Here’s what they do, why families use them, and who may not need one.

How You Hold Title in California, and Why It Can Make or Break Your Estate Plan

Most Californians don’t realize the words on their deed can decide everything — from taxes to who inherits the home. Learn the difference between Joint Tenancy, Tenancy in Common, and Community Property (and why a living trust can tie it all together). This guide turns complex title law into something fun, visual, and surprisingly easy to understand.

Will vs. Living Will: What’s the Difference (and Why You Probably Need Both)

Many people think a “Will” and a “Living Will” are the same thing — but they serve completely different purposes. One decides what happens to your assets after death, while the other guides your medical care if you can’t communicate. Learn how each works, why both matter, and how celebrity cases like Terri Schiavo and Chadwick Boseman show the real-life consequences of not planning ahead.

Foreign Trustee Trap: Why Naming Non-U.S. Persons Can Make Your California Trust a Foreign Trust

Thinking of naming a friend or family member abroad as your trustee? Learn why choosing a non-U.S. trustee may trigger foreign-trust status, tax reports, and administrative headaches — and how to protect your California legacy.

🧠 Attorney in the AI Loop: Why Estate Planning Still Needs the Human Touch

Attorney in the AI Loop: Why Estate Planning Still Needs the Human Touch

AI is reshaping the legal world, but estate planning isn’t just about documents — it’s about people. Discover why keeping an attorney in the loop ensures your plan remains accurate, ethical, and deeply personal, even in an age of automation.

🎁 Before the Holidays Arrive: The Perfect Time to Get Your Estate Plan in Order

The holidays are the perfect time to protect your family’s future. Learn why end-of-year estate planning can prevent stress, save taxes, and bring peace of mind — from DeCosimo Law in Temecula, CA.

🕊️ You Die — Now What? Understanding the Responsibilities of a Trustee in California

Discover what a trustee must do under California law after someone passes away — from managing assets and notifying beneficiaries to avoiding common mistakes. Learn what a trustee is (and isn’t) responsible for.

Understanding Heir Distribution: Per Stirpes, Per Capita, and By Representation

When a beneficiary passes away before inheriting, how should their share be distributed to their descendants? Estate planning law offers three main methods: per stirpes, per capita, and by representation. Each creates a different outcome for children and grandchildren, which can dramatically affect fairness and clarity in your legacy. In this post, we break down each method with simple examples and diagrams so you can better understand how they work and which might be right for your family.

When Legacies Collide: Lessons from the Richard Simmons and Shelley Duvall Estates

The recent passing of celebrities like Richard Simmons and Shelley Duvall has sparked public conversations about their complex estates. Beyond the headlines, these stories offer crucial lessons for all of us. Learn why having a proactive and personalized estate plan is the only way to protect your legacy and your loved ones from a painful legal battle.

The $1.5 Million Estate Planning Mistake You Can't Afford to Make

You think you've done everything right with your estate planning. Then tragedy strikes, and a simple paperwork error costs your children $1.5 million in taxes. This isn't a hypothetical scenario—it's exactly what happened to the Rowland family in Ohio. Discover the costly mistake that devastated their legacy and how to make sure it never happens to yours.

When Every Dollar Counts: How Labor Day Reminds Us That Life & Legacy Planning Is More Essential Than Ever

This Labor Day, as American workers face rising costs and shrinking paychecks, protecting what you’ve built has never been more critical. Discover how Life & Legacy Planning ensures every dollar you’ve worked for goes directly to your loved ones—without being lost to legal complications or unnecessary fees.