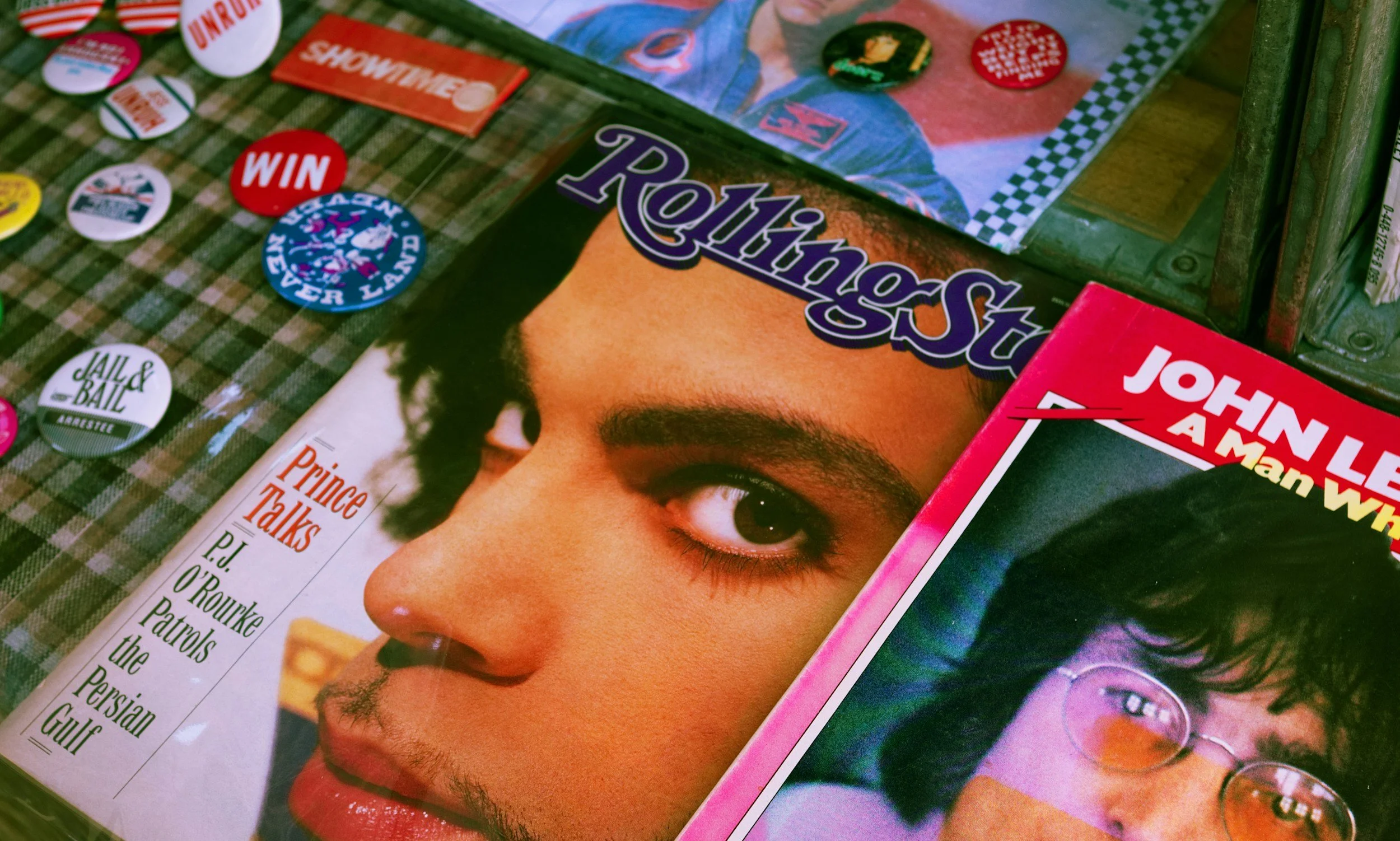

What Went Wrong With Prince’s Estate — and How It Could Have Been Avoided

Prince Rogers Nelson was a musical icon, a creative genius, and one of the most financially successful artists of all time. But when he died in 2016 at age 57, he left behind something shockingly incomplete:

No will. No trust. No estate plan.

What followed wasn’t just sad—it was expensive, public, and completely avoidable.

This is the story of what went wrong with Prince’s estate, why it spiraled into years of litigation, and what anyone—famous or not—can learn from it.

The Shocking Starting Point: Prince Died Intestate

When Prince passed away, his estate was estimated at $150–300 million, including:

His Paisley Park compound

A massive music catalog and publishing rights

Unreleased recordings (the famous “vault”)

Royalties, intellectual property, and branding rights

And yet, under Minnesota law, Prince died intestate—meaning without a will or trust.

That single fact triggered everything that followed.

Step One of Chaos: The State Took Over

Because there was no plan:

The probate court took control

The state of Minnesota decided who would inherit

Prince’s wishes—if he had any—were legally irrelevant

Under intestacy law, his estate passed to his six legal heirs (siblings and half-siblings). But identifying and confirming those heirs took months, and the disputes started immediately.

Years of Fighting, Millions Burned

1. Family Disputes & Heir Conflicts

Relatives who barely knew Prince suddenly had legal claims to tens of millions of dollars. Some had never spoken publicly about him before. Others challenged who qualified as an heir.

2. Outside “Partners” Enter the Picture

Music companies and advisers stepped in to help manage the estate—but not without controversy. Several deals were later challenged or reversed.

3. Legal Fees Skyrocketed

By the time the estate was settled, tens of millions of dollars had gone to:

Attorneys

Administrators

Appraisers

Consultants

Accountants

Money Prince earned through decades of work—gone to process instead of people or causes he may have cared about.

Taxes: Another Massive Hit

Because there was no proactive tax planning:

The estate faced significant federal estate taxes

Valuation disputes with the IRS lasted years

Some assets had to be sold or licensed quickly to raise cash

With proper planning, many of these taxes could have been reduced, deferred, or structured differently.

The Vault Problem: Who Decides Prince’s Legacy?

Prince famously guarded his unreleased music. After his death:

Decisions about releasing new music were made by committees

Some releases conflicted with what fans believe Prince wanted

Business priorities often outweighed artistic ones

Without written instructions, Prince lost control of his own legacy.

The Final Irony

Prince was:

Meticulous about control

Fiercely independent

Deeply private

Yet in death, his life’s work became:

Public court records

Media headlines

A multi-year legal spectacle

Everything he guarded while alive became exposed.

What Prince Could Have Done Differently

Here’s the hard truth: this was preventable.

1. A Revocable Living Trust

A trust could have:

Avoided probate entirely

Kept his estate private

Appointed decision-makers he trusted

2. Clear Instructions for His Music & Brand

He could have specified:

What gets released

What never gets released

Who controls licensing and branding

3. Tax Planning

With proper structuring:

Estate taxes could have been reduced

Liquidity issues avoided

Forced sales prevented

4. Trustee & Successor Planning

Instead of courts and committees, Prince could have chosen:

A professional trustee

A trusted advisor

Or a combination of both

The Big Takeaway (For Everyone)

You don’t need to be worth $300 million to end up in chaos.

If you die without a plan:

The state decides

Your family may fight

Your assets become public

Your money shrinks

Your wishes may be ignored

Prince’s story isn’t about celebrity—it’s about control.

Why This Matters Now

Most people assume:

“I’ll get to it later.”

“My family will figure it out.”

“I don’t have that much.”

Prince probably thought something similar.

And yet, his estate became one of the most expensive and public estate failures in modern history.

Final Thought

Estate planning isn’t about death.

It’s about protecting what you built, the people you love, and the story you leave behind.

Even legends need a plan.

This article is a service of Deanna DeCosimo. We don’t just draft documents; we ensure you make informed and empowered decisions about life and death, for yourself and the people you love. That's why we offer a Life & Legacy PlanningⓇ Session, during which you will get more financially organized than you’ve ever been before and make all the best choices for the people you love. You can begin by calling our office today to schedule a Life & Legacy Planning Session.

This material was created for educational and informational purposes only and is not intended as ERISA, tax, legal, or investment advice. If you are seeking legal advice specific to your needs, such advice services must be obtained on your own, separate from this educational material.